Shoppers will be looking for year-end deals like they always do as the holidays approach, but more of them will be using artificial intelligence to do it, according to a report released Monday by the global management consulting firm Boston Consulting Group (BCG).

GenAI tools such as ChatGPT, Gemini, and Google AI have become practical shopping aids, guiding consumers at critical decision points and helping them make faster, more confident choices about what to buy, which brand to choose, and where to find the best deals, the firm noted in its annual Black Friday survey of more than 10,000 consumers in 10 countries.

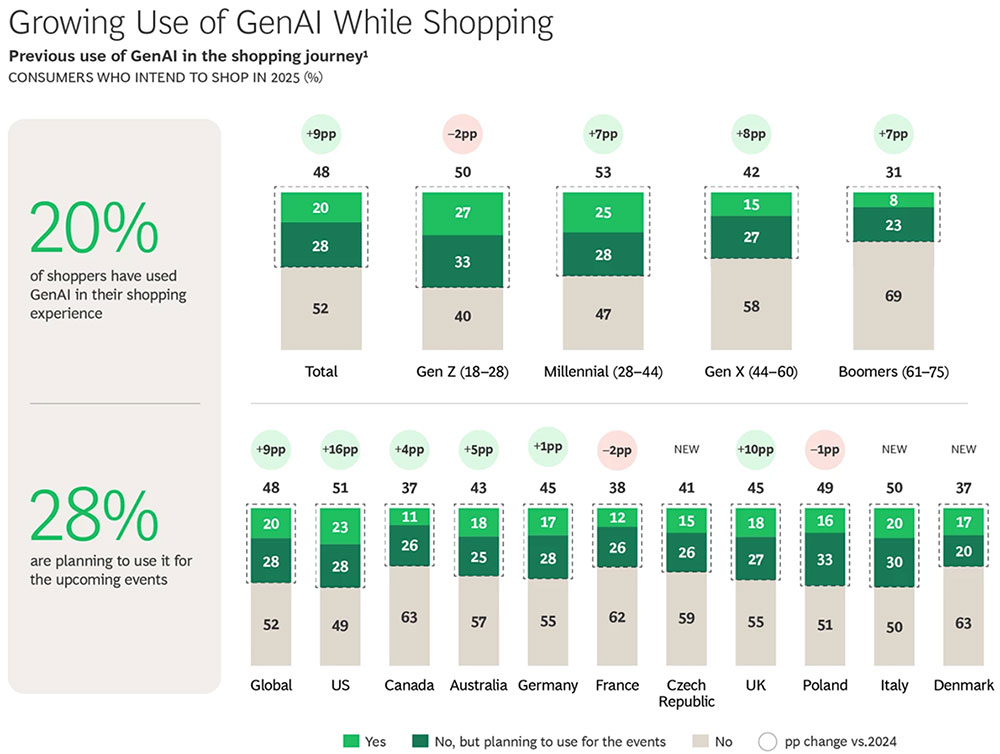

It added that the 2025 survey reveals a clear surge in GenAI usage across all countries, with 48% of consumers having already used or planning to use GenAI during year-end sales events, a nine percentage point increase over 2024.

Source: BCG Black Friday Consumer Study, October 2025 (unweighted, N = 10,240 across the U.S., Canada, Australia, Germany, France, Czech Republic, U.K., Poland, Italy, and Denmark).

“This growth is consistent across most countries and reflects both rising enthusiasm and greater trust in GenAI as a shopping assistant,” BCG Managing Director and Partner Tiffany Yeh told the E-Commerce Times. “It has become a key influence at critical decision points in the customer journey.”

She added that 46% of shoppers use GenAI to compare products, 44% rely on it to find the best deals for specific items, and 42% turn to it for technical product information.

“For retailers, this means visibility must extend beyond traditional search engines,” she explained. “To appear in AI-driven answers, they must ensure structured, machine-readable product data and maintain consistent pricing logic so that GenAI can accurately interpret, surface, and recommend their offerings.”

“Research of products, substitutions, and lowest costs is already part of most shoppers’ operating steps when shopping, but now GenAI can also support event-based shopping with deeper personalization to the shopper’s needs,” added Ananda Chakravarty, vice president of research for retail at IDC, a global market research company.

“Retailers must include GenAI in their omnichannel strategy to reach customers,” he told TechNewsWorld. “This may also mean higher reliance on loyalty and rewards programs specifically offered through retailers, plus ways of offering improved content.”

New Discovery Pathways for Retailers

Tarun Chandrasekhar, president and chief product officer at Syndigo, a data management company in Chicago, maintained that for retailers, generative AI has become the new storefront for product discovery and decision-making.

“Consumers are no longer just searching,” he told the E-Commerce Times. “They’re conversing with AI tools that guide them toward purchase decisions. That creates both opportunity and pressure.”

“These AI models depend on large volumes of clean, complete, and context-rich product data to determine what to recommend,” he continued. “Retailers and brands that ensure their content is accurate, structured, and enriched with metadata will have a far greater chance of being visible in these AI-driven ecosystems.”

Consumers are looking for immediate answers on what to buy, where to buy it, and why, explained David Hunter, CEO of Local Falcon, an SEO analytics platform, in Erie, Pa. “For retailers, this is a big shift,” he told the E-Commerce Times. “Their visibility now relies on more than just SEO. It depends on whether their brand shows up inside those AI answers.”

“Retailers don’t just need a good website,” he contended. “They need strong, structured, and trustworthy signals across the entire web that can easily be read and identified by AI. Without it, they risk going unnoticed and potentially being forgotten among their competitors, who are adapting to the times.”

“To be clear, GenAI shopping tools give retailers both an opportunity and a challenge,” added Mark N. Vena, president and principal analyst at SmartTech Research, a technology advisory firm in Las Vegas. “They’re shaping consumer decisions in real time, often replacing traditional search and comparison methods,” he told the E-Commerce Times. “To stay visible, retailers need to optimize their data so AI models can easily surface their products, reviews, and pricing. In essence, retailers must learn to ‘market to the machine’ as much as to the customer.”

AI Gaining Trust Across Generations

The BCG report also found that AI is expanding among Gen X consumers, with usage jumping eight percentage points over the last year to 42%, and among baby boomers, it climbed seven percentage points to 31%. “This shift marks GenAI’s transition from a novelty for early adopters to a mainstream shopping companion across generations,” BCG’s Yeh said.

“For older consumers, trust, simplicity, and reliability are key,” she continued. “AI tools must provide transparent, easy-to-navigate experiences. Retailers and brands should design inclusive interactions that combine personalization with clarity and control.”

“The report shows that GenAI is becoming trusted by groups that are typically slow to adopt new technologies, suggesting a rate of change in behavior that is unprecedented,” added Rob Enderle, president and principal analyst at the Enderle Group, an advisory services firm in Bend, Ore.

That trust will be important for the next big AI trend: agentic AI. “Once you trust AI, you could have your AI agent just do the shopping for you,” Enderle told the E-Commerce Times. “The agent, based on social media training, could make a better gift selection for you, removing much of the shopping anxiety and work.”

“The adoption of AI is unprecedented, and we expect that agentic commerce will follow a similar trajectory,” added Katherine Black, a partner and food, drug, and mass market lead at the global strategy and management consulting firm Kearney.

“Unlike other technologies, the learning curve for GenAI, particularly for research and discovery, is very flat,” she told the E-Commerce Times. “It takes limited time to understand how to use it, and the technology rewards the user to continue to prompt and get more information, so adoption scales very quickly.” Black noted that in the coming years, as agentic commerce scales, it will have a massive impact on retailers.

“Kearney is expecting up to 500 basis points in earnings before interest and taxes to shift away from retailers in some categories due to the shift to smaller basket size — which will eliminate halo and increase fulfillment costs — price compression from increased price transparency, and the shifting of high-margin revenue, like retail media dollars, flowing to agentic platforms,” she said.

Retail Discovery Moves to AI Agents

BCG’s Yeh noted that agentic AI is poised to transform shopping from an active, search-driven activity to a delegated process where AI agents manage discovery, comparison, and even purchasing on behalf of users.

“This evolution poses a risk for retailers who may lose direct contact with consumers unless they integrate their data and products into these AI ecosystems,” she said. “To stay relevant, retailers should consider developing brand-owned agents and optimizing their visibility across third-party AI platforms.”

“They must also reinforce direct customer relationships through loyalty programs, exclusive rewards and personalized offers — reducing reliance on third-party intermediaries and mitigating churn,” she added.

Rob Garf, head of retail strategy and insights at Cordial, a cross-channel marketing platform in San Diego, contended that society is witnessing the most significant shift in how consumers discover brands since the rise of search engines.

“One-third of shoppers already use AI personal agents for discovery and inspiration, and this number is expected to surge to at least 50% by 2026,” he told the E-Commerce Times. “But here’s what retailers need to understand: This isn’t about pushing consumers to your website anymore. It’s about pushing your brand to where consumers already are.”

“Just like search engine optimization became table stakes in the 2000s, agent engine optimization is the new battleground,” he explained. “These platforms understand context and memory. They know a specific shopper ran a marathon two years ago, has a hip injury, and needs wide-width shoes.”

“The brands that syndicate rich, structured product data and make themselves discoverable in these walled gardens will own this new shopping mall,” he continued. “The ones that don’t? They’ll simply be invisible to an increasingly large segment of high-intent shoppers.”