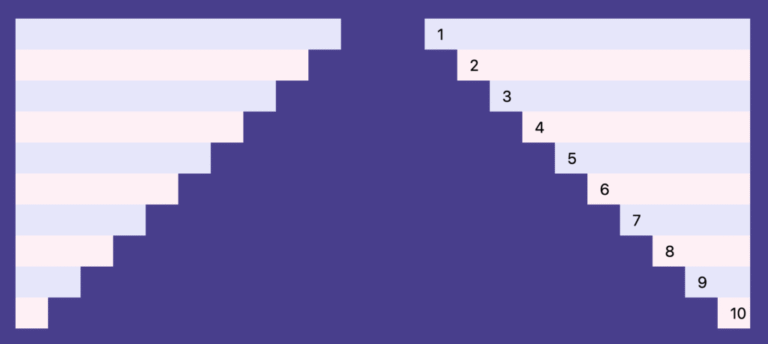

The Council of the European Union has approved new customs rules for imported parcels valued at up to 150 euros. These shipments were previously exempt from customs duties, but that will change on July 1. From that date, a flat rate of 3 euros will apply to each item category contained in a small parcel entering the EU.

The influx of parcels – particularly from China – has become a growing concern for member states. Last year, 5.8 billion low-cost ecommerce parcels entered the EU. That represents an increase of 26 percent compared to 2024 and more than four times the volume recorded in 2022.

Customs authorities struggling

Customs authorities in the member states are struggling to inspect the contents of the billions of parcels entering the Union each year. In practice, this has proven unmanageable, allowing unsafe products to enter the market. This is not only harmful to EU consumers, but also to the competitive position of European companies.

Most goods do not comply with EU rules and standards

A recent large-scale customs control operation revealed that most goods shipped directly to EU consumers from third countries do not comply with EU product rules and safety standards. “However, the expansion of ecommerce-driven imports outpaces the rate at which control measures can be implemented”, the European Commission wrote following the publication of the findings.

EU Customs Data Hub

Most of the parcels originate from China, driven by platforms such as AliExpress, Shein and Temu. After years of rapid growth, their expansion has recently begun to slow. Growth may decelerate further following the abolition of the threshold-based customs duty relief for parcels valued under 150 euros entering the EU. Customs tariffs will apply to all goods entering the Union once the EU Customs Data Hub becomes operational, which is currently expected in 2028.

Interim flat-rate customs duty

Until then, member states have agreed to introduce an interim flat-rate customs duty of 3 euros on items contained in small parcels valued at less than 150 euros and sent directly to consumers in the EU. The duty will be levied on each different category of item.

For example, if a parcel contains two distinct item categories, 6 euros in customs duty would be payable. The measure is separate from the proposed so-called ‘handling fee’ that is currently under discussion as part of the broader customs reform package.