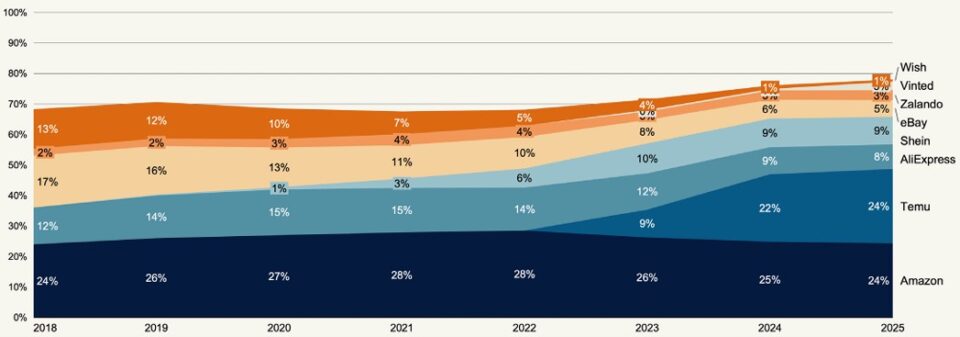

In a short period of time, Temu has become a dominant player in global ecommerce. Nearly a quarter of consumers (24 percent) made their most recent cross-border purchase on the Chinese platform. This puts Temu on par with Amazon.

This is shown by the Cross-Border E-Commerce Shopper Survey 2025 conducted by the International Post Corporation (IPC). The report is based on data from 30,970 shoppers in 37 different countries, including many European countries, as well as Australia, Canada, China, Mexico, New Zealand, South Korea, and the United States.

Temu, the international platform of China-based PDD Holdings, launched in the United States in September 2022. In the spring of 2023, Temu opened a headquarters in Dublin and rolled out its platform in European countries. It also became available in dozens of other countries worldwide.

Temu’s explosive growth

Of the respondents in the IPC study — for which fieldwork was conducted in September 2025 — 24 percent made their most recent cross-border online purchase at Temu. By comparison, in 2022 this share was just 1 percent, and a year earlier the platform did not even exist.

Temu’s share grew from 1% to 24% in three years

Amazon also recorded a share of 24 percent in the international survey. From this perspective, Amazon and Temu together account for nearly half of all cross-border sales. Incidentally, the order shares say nothing about spending levels on the platforms; it can be assumed that average order values on Temu are significantly lower than on Amazon.

Shein stable, AliExpress declines

Shein’s share, the number three in cross-border transactions, remained stable last year at 9 percent. AliExpress declined from 9 to 8 percent. eBay accounts for 5 percent, while Zalando is the first European player with a share of 3 percent.

However, Temu’s growth in Europe has now slowed. In the first half of last year, the number of users increased by ‘only’ 12.5 percent to 115.7 million. The platform hopes to become faster and more attractive by shipping products primarily from local warehouses in the future, also partnering with European sellers.

China’s dominance

The IPC report also includes country rankings showing the top three destinations for cross-border purchases. China ranks first in 26 of the 30 European countries. Consumers in Luxembourg and Austria shop online more often in Germany than in China, while in Ireland and Iceland they most frequently shop across the border in the United Kingdom.