The e-commerce platform market is driving a major shift in how technology is bought, sold, and reused. A growing secondary resale ecosystem is replacing the long-dominant “take-make-dispose” model, enabling devices to circulate through multiple lifecycles instead of ending up as waste — and creating new revenue opportunities along the way.

This sector, projected to grow from an estimated $9.07 billion in 2025 to $16.50 billion by 2030 (a CAGR of 12.7%), presents a prime opportunity for tech companies to capitalize on secondary devices by sharing, leasing, repairing, and reselling existing materials.

This strategic move not only combats the mounting global e-waste crisis but also opens access to price-sensitive, environmentally conscious customers who increasingly seek affordable, lower-impact technology options, according to Jacob White, senior manager of pricing and operations at Callisto, a wholesale marketplace platform.

“Refurbished and pre-owned tech creates an entry point for more price-sensitive customers, expanding reach while also increasing sales volumes. For e-commerce businesses, this translates to stronger margins and faster stock turnover,” he told the E-Commerce Times.

From his perspective, electronic devices are too valuable to throw away. It worsens the e-waste problem, which results in more than 50 million tons of electronics rotting in landfills each year. Refreshed and resold devices create additional profit channels while reducing environmental footprints.

“This means that e-commerce businesses are in the perfect position to expand their customer base with more affordable options,” White added.

Scaling Circular Tech in E-Commerce

Table of Contents

E-commerce marketplaces are becoming the operational backbone of the circular economy. They supply the platforms, pricing visibility, and transaction infrastructure that make it financially viable for tech businesses to shift from one-time sales to ongoing resale and recovery models.

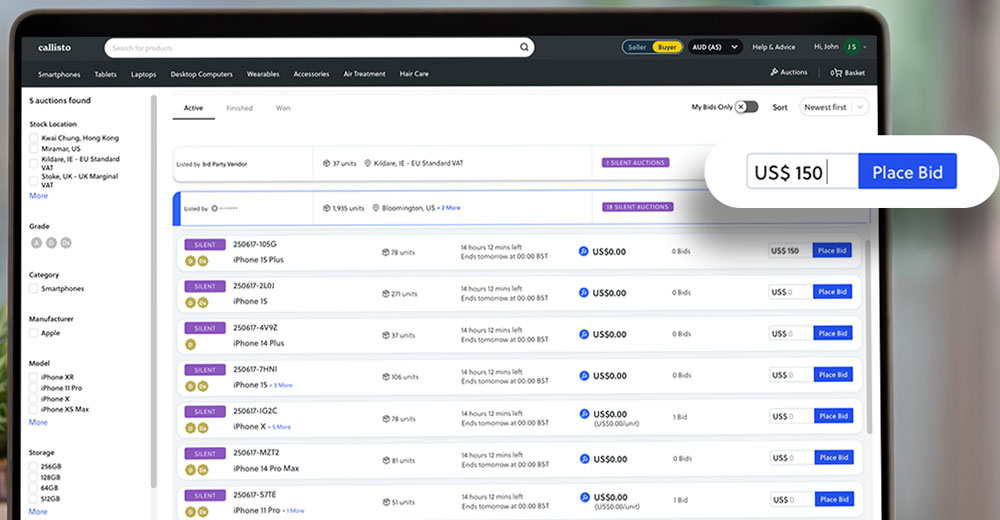

Marketplaces such as Callisto act as platforms for a range of activities that would be difficult to execute in a traditional, brick-and-mortar retail environment. Buying secondary tech wholesale requires consistent grading standards, transparent stock availability, and secure transactions, White noted.

“These are critical to building confidence that what you buy is what you can sell profitably,” he added.

“Growth then comes from diversifying into categories like gaming equipment, wearables, and home electronics, and from using global wholesale marketplaces to access consistent, scalable supply,” White explained. “The real winners will be those who expand beyond their existing networks and customer base and tap into international demand through digital trading infrastructure built for scale.”

Potential Black Friday Sales Booster

With Black Friday approaching on Nov. 28, the retail narrative is shifting from hype-driven consumption to value-driven purchases and sustainability. In the wake of rising tariffs, tech costs, and an increasingly climate-conscious consumer base, circular or refurbished tech is emerging as the more intelligent choice for budget-conscious shoppers, according to James Murdock, co-founder of the circular tech firm Alchemy.

The most brilliant buy is not the cheapest. It is the one that lasts, he asserted. Quality tech deserves a second life.

“Circular products prove that durability and design still hold value long after the first purchase. For consumers, it’s a win: access to premium devices at better prices, with a lighter environmental footprint. For brands, it’s a strategic shift. Resale, refurbishment, and trade-in programs aren’t just good PR. They’re unlocking new revenue streams and deepening customer loyalty,” Murdock told the E-Commerce Times.

In his view, circular tech is not a niche. It is the new normal. Retailers who embrace it are not just selling products; they sell a sustainable new model for tech consumption.

Alchemy is helping define what circular tech looks like at scale. To date, it has recovered over 12 million devices and returned $2 billion to consumers through trade-ins. By partnering with telcos, retailers, and OEMs, Alchemy builds the reverse logistics networks and resale infrastructure needed to turn used devices into a repeatable revenue stream.

Integrated Resale Platform

Alchemy and Callisto function as a single, integrated resale system. Alchemy handles device recovery, processing, and large-volume B2B trading, while Callisto, which Alchemy owns and operates, serves as the digital marketplace layer where buyers and sellers transact.

The Callisto marketplace interface enables buyers and sellers to transact refurbished devices.

While Callisto serves as Alchemy’s marketplace layer, it is one part of a broader circular tech ecosystem. Other platforms in this space include Back Market, Foxway, LoopOS, Evercycle, and Reebelo, each supporting different stages of refurbishment, resale, or lifecycle management.

According to Callisto’s White, trust is the core differentiator in the secondary tech market. Marketplaces that offer clear device information and consistent grading standards are the ones that scale.

That means removing guesswork with reliable grading and clear device condition data.

“When trading becomes predictable and repeatable, instead of one-off deals, that’s when businesses can scale,” White observed. “For buyers and sellers in the e-commerce space, this level of clarity translates into confidence.”

For instance, sellers know that listed devices will move quickly, and buyers know that what they purchase will resell profitably, he explained. That reliability builds customer loyalty and encourages faster, higher-volume trade.

Tips for Reselling Success

White said that tech resellers must do more than list used phones or laptops online. Success comes from providing a trade-in of old devices and managing every stage of the lifecycle, from the moment a customer trades in a device to the point it is resold.

That means securely recovering devices from consumers and enterprises, accurately grading their condition, carrying out automated data wiping, and preparing them for resale with proper remarketing and sustainability certification.

“Partnering with an end-to-end solutions provider makes this process seamless, ensuring e-commerce companies don’t have to juggle multiple providers or risk gaps in quality and compliance,” he detailed.

For e-commerce merchants, offering customers the option to trade in an old device can significantly increase the affordability of a new device. A holistic lifecycle approach protects device value and shortens time-to-resale, according to White. The result is higher sales, increased profitability, and reliable new sales channels that capture growing consumer demand.

However, e-commerce companies must first invest in used tech to realize this kind of growth and expansion. New devices alone limit audience reach, while secondary inventory opens up access to new customers, creates repeatable sales patterns, and provides the scalable supply needed to build long-term growth.

Lifecycle Drives Value

The Alchemy-Callisto combination maximizes efficiency and value recovery. White sees too many companies treating sourcing, refurbishing, and reselling as separate functions. Alchemy’s solution demonstrates the advantages of integrating these steps into a single, seamless framework.

It integrates Alchemy Circularity for trade-in and processing, Alchemy Trading for large-volume sourcing, and Callisto as the live marketplace. This model delivers end-to-end traceability and captures more value from each device.

“By bringing these processes together under one roof, sellers can secure a more reliable supply chain and resell devices faster. On the buyer side, consistent grading, clear certifications of device condition and data security, and reliable availability of refurbished stock make it easier to source devices confidently and profitably,” White concluded. Both sides win.

Images in this article were supplied by Callisto.