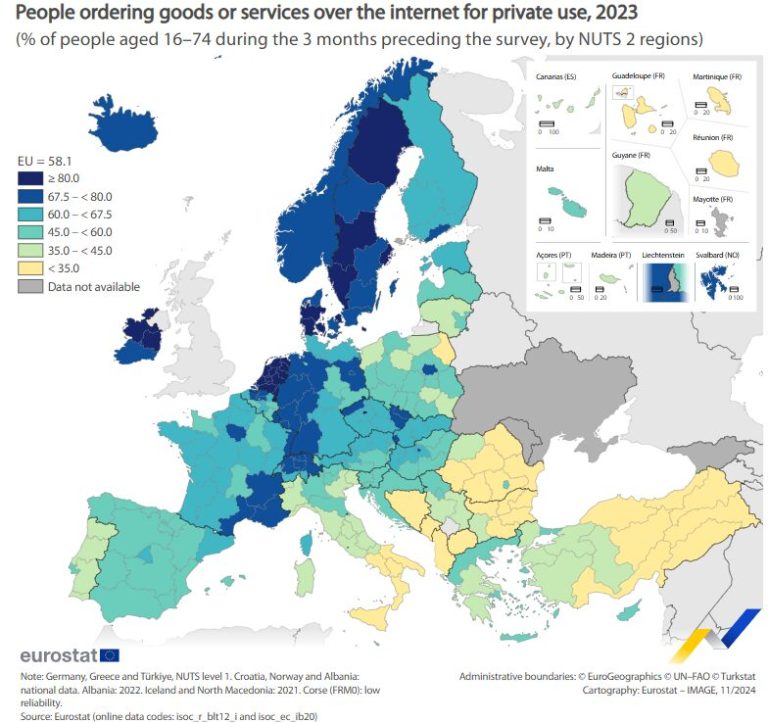

After two years of decline, online product spending in Germany has increased once more. In 2024, spending reached 80.6 billion euros, an increase of 1.1 percent. Stronger growth is expected for this year.

This was reported by the Bundesverband E-Commerce und Versandhandel Deutschland, or bevh for short. After years of strong growth during the pandemic, online spending dropped significantly: by 8.8 percent in 2022 and, for the first time in history, by double digits in 2023. This 11.8 percent decline to 79.9 billion euros marked a low point in German ecommerce.

Growth categories

Online product spending has now returned to over 80 billion euros. Medications, groceries, and pet supplies saw the highest growth, with all these categories growing by more than 5 percent. Online fashion spending remained more or less stable, while online electronics sales declined, despite the European Football Championship being held in Germany.

The share of marketplaces grew to 55%

The share of online marketplaces, including market leader Amazon, grew from 53 to 55 percent, partly driven by the increasing role of platforms from China, which accounted for 6 percent of orders. Germany is the top European market for Temu and Shein, as revealed by data from these companies at the end of last year.

Post-pandemic dip

Total product spending remains far behind the levels of the record year 2021, when Germans spent 99.1 billion euros on online products. With a gap of 18.5 billion euros, the post-pandemic dip is far from over. The online share of total retail spending also decreased last year, from 10.2 percent to 10.1 percent.

Improvement

The market is expected to recover further in 2025. In a joint forecast, bevh and the EHI Retail Institute predict nominal growth of 2.5 percent for ecommerce in Germany this year. “Ecommerce is back in positive territory, despite the poor consumer sentiment in Germany”, explains bevh president Gero Furchheim. “We anticipate sustained and, in the medium term, stronger growth for our sector.”

‘We anticipate sustained and stronger growth.’

Risks include new crises, uncertainties surrounding the national election, and further geopolitical tensions, according to Furchheim. “However, with positive impulses, there is potential for faster growth, especially since many consumers have built up savings due to high interest rates.”