The days of declining online sales in Germany appear to be over. Last year the net sales of the top thousand webshops fell by 0.2 percent, not adjusted for inflation, compared to a 2.8 percent decline in 2022. A nominal growth is expected for this year.

This is reported by EHI and ECDB in their research E-Commerce Market Germany 2024, where they also published a new top thousand list of online sellers in the country.

Growth path on the horizon

Until 2022, online spending in Germany had been growing for fifteen consecutive years. The pandemic years of 2020 and 2021 saw particularly strong growth. A ‘post-covid rebound’ followed: in 2022, the combined revenue of the top thousand online retailers decreased by 2.8 percent. With a 0.2 percent decline in 2023 (a reduction of 164 million euros to a total of 77.5 billion euros), the growth path seems to be emerging again.

“Online commerce is returning to the development curve that would have been expected without the pandemic”, says EHI researcher Lars Hofacker. “For the current year, we expect a moderate nominal growth of 1.1 percent in the revenue of the top thousand online stores.”

EHI predicts 1.1% growth for the top thousand this year.

Before the pandemic, the revenue of the top thousand online stores had grown by an average of 10.7 percent annually since 2008.

Amazon pulls ahead

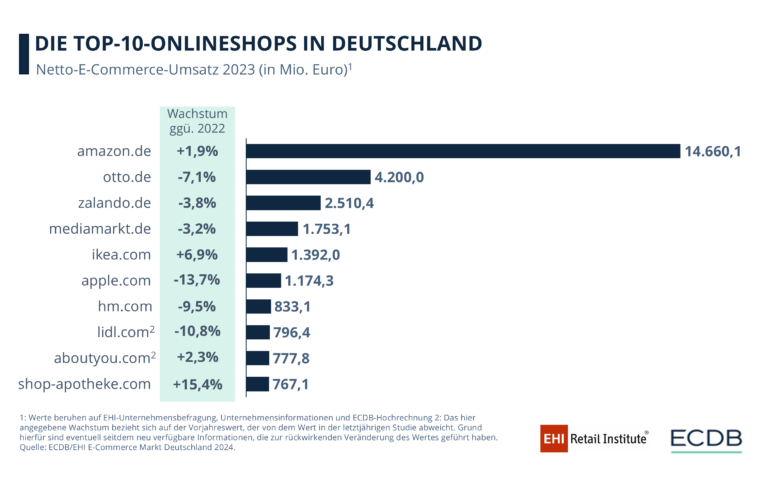

A look at the top ten revenue leaders shows that Amazon has distanced itself from runners-up Otto, Zalando, and MediaMarkt. Number 5, Ikea, which dominates the German online furniture market alongside Amazon, is the next grower on the list, leaving behind Apple, H&M, Lidl, About You, and the fast-growing Shop Apotheke.

Top 3 marketplaces

Amazon also leads the German list of the largest marketplaces published by EHI and ECDB. For this list, gross merchandise value is the key metric rather than net sales. At a significant distance from Amazon (51.4 billion euros), eBay holds second place (8.9 billion euros), and Otto is in third place (6.5 billion euros).