When budgeting for a point-of-sale (POS) system, it’s essential to consider more than just the upfront price of the hardware. A POS system’s total cost includes several components, from physical devices to software subscriptions, transaction fees, and other hidden expenses that can add up over time.

It’s important to understand these costs upfront to make an informed decision and choose a POS system that fits your business’s needs and budget. There are usually two main components to POS system cost: the price of hardware, which may be a one-time outright purchase or a monthly recurring rental fee, and the price of software, often a monthly subscription fee. If your POS system has built-in payment processing, you’ll also pay for those fees as part of your total POS cost.

Table of Contents

POS costs at-a-glance

Range of cost

POS hardware

Basic card reader

All-in-one terminal

$199 to $799

Full set-up

$799 and up

POS software

Monthly subscription fees

$0 to $165

POS payment processing fees

Per-transaction fees

POS hardware costs

The cost of POS hardware can vary significantly depending on the equipment or device that you need. Depending on how sophisticated your POS system needs to be, typical hardware costs can range from $0 to over $1,000.

Free POS hardware

Many small businesses may not want to spend anything on their POS hardware. This is possible with some providers like Square that offer a free card reader for their merchants.

Another option is to choose a provider that offers tap to pay on iPhone or Android. This feature allows any compatible iPhone or Android phone to function as a contactless card reader, eliminating the need to buy a separate card reader to accept payments.

Purchasing POS hardware

Here are some sample prices of POS card readers and other POS hardware devices for Square and Clover, two of the most popular POS systems in the market:

Basic card reader

Standalone POS terminal

$279 to $599

Receipt printer

$299 to $549

$130 to $300

Barcode scanner

$119 to $229

$135 to $250

Cash drawer

$129 to $549

$114 to $169

Customer-facing display

$799 to $1,799

Self-serving kiosks

Related: Read our detailed comparison of Clover vs Square.

When budgeting for POS hardware, it is important to consider costs beyond the initial purchase price. Factor in potential expenses for additional devices when scaling up, replacement parts, peripherals, and technology upgrades.

POS software fees

POS software fees vary depending on the type of system you choose and the specific features you need for your business. Some POS providers charge a one-time licensing fee for their software, while the increased adoption of cloud-based POS also popularized the subscription-based model with monthly or annual fees.

The cost can range from $0 for basic, entry-level software to several hundred dollars per month for more advanced solutions that include inventory management, customer relationship management (CRM), and industry-specific features. If your business requires third-party software such as accounting, e-commerce platforms, or payroll services, there may be additional fees for those integrations.

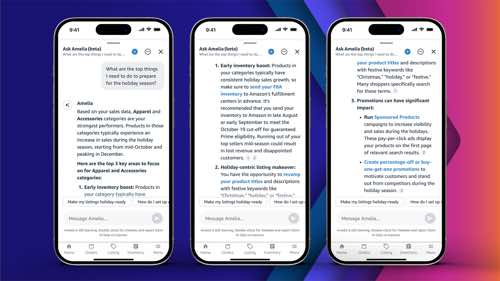

Some simple mobile POS solutions, such as Square, Shopify, and PayPal Zettle, can easily be installed on your mobile device, and you can already start accepting payments without any additional hardware using Tap to Pay. Here are typical POS software fee ranges for some of the best POS system providers:

Additionally, be aware of potential setup fees that some providers charge to help install and configure the software for your business.

Related: Read our detailed comparison of Square vs Shopify.

Transaction and processing fees

A huge portion of ongoing POS system costs goes to transaction and processing fees. These fees are typically charged by the payment processor every time a customer makes a purchase with a credit or debit card or ACH payment. For card transactions, the fees usually include a combination of: an interchange fee, which is paid to the issuing bank; an assessment fee, which goes to the card network; and a processor markup fee, which is for the payment processor.

Interchange fees often range from 1.5% to 3.5% of the transaction amount, depending on the type of card and the transaction method. Processor fees may be a flat fee per transaction, such as $0.05 to $0.30, or a percentage of the transaction amount, such as 0.2% to 1%.

The structure of fees may vary significantly depending on the payment processor. Here is a quick rundown of the different pricing structures for processing fees:

- Interchange-plus pricing: A transparent pricing model where you pay the actual interchange fee plus a fixed markup from the processor.

- Flat-rate pricing: A simplified pricing model where you pay a consistent percentage rate for all transactions, regardless of interchange fees for that transaction.

- Tiered pricing: A pricing model that categorizes transactions into tiers with different rates for each.

- Subscription model: A pricing structure where you pay a fixed monthly fee for a set amount of transactions, plus a small per-transaction fee.

- Surcharging: A method where businesses pass on credit card processing fees to customers by adding a surcharge to credit card transactions.

Below are some of the range of processing fees for some of the most popular POS systems. As you can see, they typically average between 2% and 3% for in-person transactions, and 3% to 4% for online transactions.

Pricing Structure

In-Person Transaction Fee

Online Transaction Fee

2.5% to 2.6% + $0.10

2.9% + $0.30

2.49% to 3.29% + $0.15

3.5% to 3.89% + $0.15

2.4% to 2.6% + $0.10

2.5% to 2.9% + $0.30

Interchange-plus

Interchange +

0.25% to 0.4% + $0.06–$0.08

Interchange +

0.15% to 0.5% + $0.15 to $0.25

2.29% + 9 cents

3.49% + 9 cents

Related: Read our list of the cheapest credit card processors.

When considering a POS system, it’s essential to look beyond the obvious expenses and account for any additional or hidden fees that could impact your business. These costs can vary significantly between providers, but they often come in the form of setup fees, cancellation fees, and other charges that can catch businesses by surprise.

- Setup and installation fees: Some POS providers charge a one-time setup fee for configuring the system to meet your specific business needs. This can include software installation, hardware setup, and initial employee training, with fees ranging from $100 to $500 or more, depending on the complexity of your setup.

- Cancellation fees: If you decide to switch providers or cancel your service before the end of your contract, you may be charged an early termination or cancellation fee. These fees can range from a few hundred dollars to several thousand, depending on your agreement terms and how much time remains on your contract.

- Inactivity fees: Some POS providers impose inactivity fees if your account doesn’t reach a minimum transaction volume within a given period. This fee can be a flat monthly charge or a penalty applied when your sales dip below a certain threshold.

- Maintenance and repair fees: While many providers include basic maintenance and software updates in their service packages, there can be additional charges for hardware repairs, extended warranties, or technical support beyond the standard service level. These costs can vary, so it’s crucial to understand what’s covered under your agreement.

- PCI compliance fees: To ensure data security, many POS providers require you to comply with PCI DSS (Payment Card Industry Data Security Standard) requirements. Some providers charge monthly or annual PCI compliance fees, typically ranging from $5 to $30 per month, to cover the cost of maintaining secure transaction environments.

- Upgrade and add-on fees: As your business grows or your needs change, you may find that you need to add new features or upgrade your POS system. Providers may charge additional fees for software upgrades, new feature modules (such as advanced analytics or loyalty programs), or expanded functionality.

- Statement fees: Some payment processors charge a fee to send you a monthly statement, either by mail or electronically. While this fee is usually small (around $5 to $10 per month), it can add up over time.

- Chargeback fees: If a customer disputes a transaction and initiates a chargeback, your payment processor may charge you a fee, typically ranging from $15 to $25 per chargeback. Some providers like Helcim refund this fee if you win the dispute, but for most providers, this fee is charged even if the dispute is ultimately resolved in your favor.

- Batch processing fees: Some processors charge a fee each time you submit a batch of transactions for processing. This fee, which is often a small, fixed amount per batch (e.g., $0.10 to $0.30), can accumulate depending on how frequently you process transactions.

- Gateway fees: If your POS system relies on a separate payment gateway for online or e-commerce transactions, you may incur monthly gateway fees, which usually range from $10 to $25, plus a small per-transaction fee.