Money laundering risks are no longer confined to banks. As online commerce scales globally, retailers are finding themselves exposed to threats once limited to the financial sector.

The online retail industry presents a perfect storm of cross-border transactions, with payment methods including credit/debit cards, digital wallets, and bank transfers. These channels provide low-friction entry points for criminals to place and layer dirty money. As a result, AI-infused e-commerce platforms can provide criminals with an efficient pathway for laundering illicit funds.

The integration of AI with related technologies creates a dual challenge. It is a powerful tool for compliance, but also an accelerator for criminal activity.

Traditional anti-money laundering (AML) strategies focused on financial institutions. That focus is now expanding, as regulators such as the Financial Action Task Force (FATF) and the Financial Crimes Enforcement Network (FinCEN) push AML expectations beyond traditional financial institutions, prompting e-commerce platforms and payment providers to implement more robust controls.

Online retailers are beginning to leverage third-party regulatory technology (RegTech) solutions providers. Their sophisticated technologies help retailers keep pace with the evolving and AI-enabled money-laundering risks.

According to Eleni Panagiotopoulou, head of AML at online gambling software company Softswiss, industry data shows that laundering-related fraud now accounts for a disproportionate share of economic crime. Organized criminal gangs use retail platforms to move money at scale without attracting the scrutiny that banks and other financial services providers face.

“Money laundering is becoming an increasingly material threat for online businesses, including typical e-commerce retailers, as criminal networks exploit digital payment flows to disguise illicit funds,” Panagiotopoulou told the E-Commerce Times.

Laundering Money Impacts Exceed Financial Loss

Table of Contents

For retailers, direct financial losses from online platforms are compounded by risks of regulatory exposure, damaged partner relationships, and erosion of customer trust when their systems are used as conduits for illicit finance. As global retailers’ payment acceptance types diversify and cross-border sales increase, the e-commerce sector is shifting from a peripheral target for launderers to a core target for enablers of illicit funds.

“Criminals exploit the everyday mechanics of online retail to cycle, layer, and cash out funds,” Panagiotopoulou explained.

She noted a common method involves purchasing goods with illicit proceeds and quickly requesting digital refunds. Often, such transactions funnel tainted funds into alternative bank accounts or new payment rails, effectively converting tainted funds into clean money.

Marketplace sellers are another weak point, she noted. Fraudsters can create or breach seller accounts to receive tainted payments disguised as legitimate sales. They then move payouts through a series of accounts before regulators detect the pattern.

Launderers use real and synthetic networks of mule accounts to receive goods, store value in vouchers or digital items, and cash out through secondary markets. Because these schemes closely mimic normal consumer behavior, they often slip through systems designed to flag unusual transactions, such as credit card fraud, she added.

Regulatory Pressure Rising

According to Panagiotopoulou, regulators worldwide are extending AML requirements beyond banks to include virtual asset providers, digital platforms, and other non-financial firms that process payments and otherwise facilitate the movement of value.

“FATF’s evolving guidance, the EU’s AML legislative package, and proposed FinCEN rules in the United States all signal a shift toward holding platforms and by extension large marketplaces responsible for verifying sellers and monitoring transactions,” she said.

Despite this shift, many retailers still lack structured know-your-buyer (KYB) verification during seller onboarding, ongoing monitoring of seller payouts, or clear escalation routes for suspicious behavior. Retailers also often rely heavily on third-party payment processors without ensuring AML obligations are contractually defined.

“As compliance requirements become more stringent, the absence of robust verification, monitoring, and record-keeping exposes retailers to risks once limited to financial institutions,” Panagiotopoulou noted.

Online Commerce Ripe for Money Launderers

Online commerce is fast and frictionless, precisely the characteristics that attract money launderers. High volumes of low-value transactions allow illicit flows to blend into normal customer activity.

“So setting thresholds for the size of monetary transactions like banks do would not work for e-commerce players,” she observed.

The digital retail environment is also a contributing factor. Retailers prioritize speedy customer onboarding and easy one-click checkout, making it easier for bad-faith actors to create accounts, rotate identities, and test platform vulnerabilities at scale.

“As retailers integrate e-wallets, buy-now-pay-later options, and alternative payment mechanisms, criminals gain more opportunities to identify the weakest rail and exploit it repeatedly before detection systems spot this,” she added.

Why Money Laundering Red Flags Often Go Unnoticed

Analysts often miss warning signs that indicate money laundering on e-commerce platforms. Some of the most telling red flags are the ones that appear ordinary at first glance.

She cited, as an example, rapid cycles of small purchases across diverse product categories, followed by refunds or withdrawals. Such events often indicate testing behavior rather than genuine consumer activity.

“Geographic inconsistencies, such as payment credentials from one country, shipping to another, and device login from a third, are also common markers of mule activity.”

She suggested a few more overlooked transaction patterns. These include unusually high refund rates tied to a single buyer or seller, sudden spikes in payout activity from newly created merchant accounts, and patterns of micro-transactions that aggregate into significant value over short windows.

“These red flags can be frequently overlooked by companies that do not rely on integrated data analysis,” she noted. “All of these red flags often blend into the retail noise at first glance, but they can be detected if companies are using combined behavioral, device, and payment data analytics.”

Gearing Up to Fight Back

Small e-commerce businesses without significant IT budgets can defend against money laundering. Vendors can build credible defenses by focusing on a few high-impact controls, Panagiotopoulou suggested.

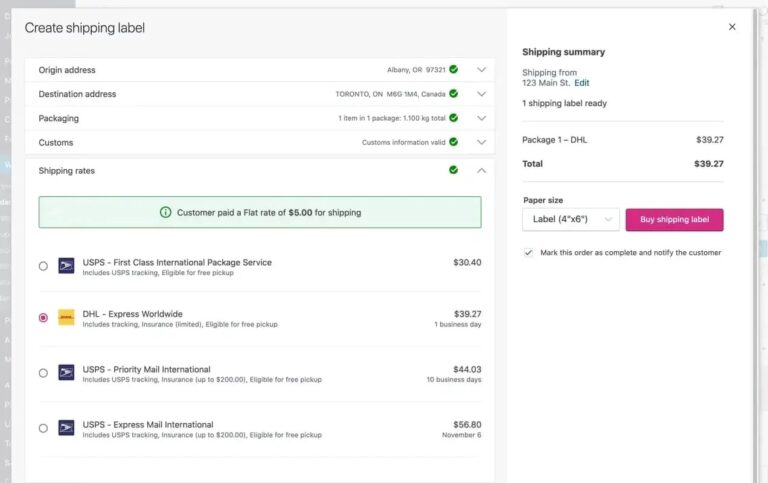

For instance, they can tighten refund workflows, limiting instant refunds to trusted customers. Another strategy is to delay large payouts until basic verification is complete. That can shut down several typical laundering schemes at low cost.

Many vendors now offer modular AML and fraud-detection tools with usage-based pricing, giving smaller firms access to device fingerprinting, risk scoring, and rudimentary KYB checks without building systems in-house, she added.

“Even simple alerts that flag unusual refund patterns, multiple shipping addresses on a single payment method, or sudden spikes in seller activity can materially reduce exposure when combined with the expertise of trained staff,” Panagiotopoulou explained.

She concluded by explaining that retailers who succeed in building effective AML systems usually start by creating a unified ID layer that ties together orders, devices, payments, and seller accounts. Additional support from event streaming or regular data pipelines enables models to assess risk in near-real time.

“Feature stores and data-governance frameworks then help standardize inputs so that multiple teams and models can work on a strong and reliable foundation,” she said.