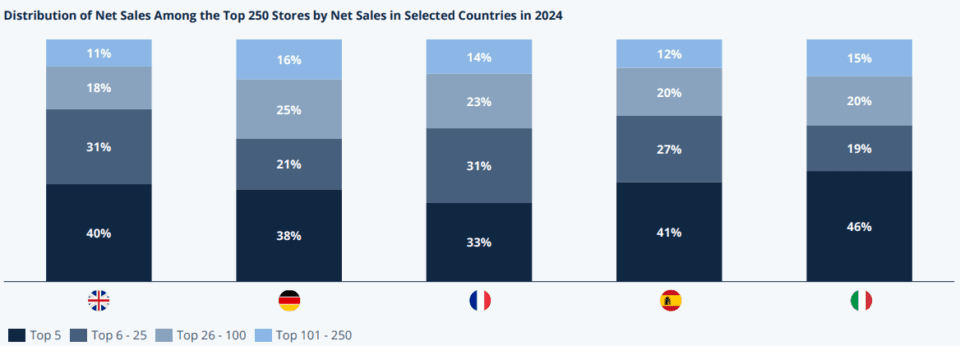

The five largest ecommerce players in Italy account for 46 percent of the sales of the country’s top 250 online sellers. Spain also sees a high concentration, with its top five players representing 41 percent of the market. In the United Kingdom, Germany, and France, the market is more evenly distributed. Yet even in those countries, the top 25 sellers are significantly larger than the 225 that follow.

‘Winner takes all’ is a well-known saying in the ecommerce world. An updated report by German ECDB, a publisher of ecommerce statistics, provides insight into the market dominance of the top players in Europe’s five largest markets.

Market concentration in Italy and Spain

According to the study, market concentration is highest in Italy. The top five players – Amazon, Shein, Apple, Zalando, and MediaWorld/MediaMarkt – account for 46 percent of the top 250’s sales. In Spain, the top five – Amazon, Shein, El Corte Inglés, Mercadona, and Carrefour – represent 41 percent:

In the United Kingdom, the top five (Amazon, Sainsbury’s, Tesco, Asda, and Argos) account for 40 percent – slightly less than in Italy and Spain. However, the share of the top 25 is higher at 71 percent, compared to 65 percent in Italy and 68 percent in Spain. This indicates that players ranked 6 through 25 perform relatively well in the United Kingdom according to ECDB’s ranking.

The UK has the highest share for the top 25

In Germany, Amazon, Otto, Zalando, MediaMarkt, and Ikea account for 38 percent of the top 250’s sales. In France, the top five – Amazon, Shein, Veepee, Auchan, and Boulanger – make up 33 percent. The top 6 to 25 is also strong there, as in the United Kingdom.

Amazon and the others

Amazon is the undisputed market leader in Europe’s five largest ecommerce markets, generating at least twice as much in sales as the second-largest player in every country. In both Italy and France, the American giant is larger than the combined total sales of the number 2 to number 5. In Spain, it is nearly as dominant.

In Italy and France, Amazon is bigger than its four closest competitors combined

The Netherlands, also a top 10 country in European ecommerce, is the exception to Amazon’s market dominance. Local player bol holds the top position in various rankings there. According to ECDB, Amazon had reached second place in the Netherlands by 2023.