Consumer research reveals that a lack of product details is a big selling problem for online marketers. Artificial Intelligence (AI) is an innovative way to bring more effective sales dialogue to the customer experience (CX).

In an age where AI has transformed nearly every industry, retailers need to harness its potential to bridge the gap between merchant speak (industry jargon) and consumer dialect, according to research optimization platform provider Lily AI released late last month.

Over the past three decades of internet-driven commerce, retailers have focused heavily on optimizing customer satisfaction. From carefully curated product selections to personalized upsell strategies, the digital storefront has become a key battleground for consumer engagement.

Yet despite these efforts, many retailers still fail to deliver the detailed, shopper-friendly language that online buyers need to make a purchase confidently.

In today’s e-commerce environment, true personalization remains elusive. Too often, shoppers struggle to find what they want because product descriptions don’t reflect how they search or think.

The Lily AI study highlights how shopper expectations are evolving, what retailers must do to meet them, and how AI is poised to power a new era of online retail.

According to Lily AI Co-founder and CEO Purva Gupta, despite efforts to curate outstanding assortments, retailers and brands are leaving money on the table.

“Merchants and marketers have a real opportunity to elevate customer satisfaction, increase sales, and drive operational efficiency, all by describing their products more clearly and comprehensively, both in customer-facing content as well as on the back-end,” she told the E-Commerce Times.

As AI increasingly influences how consumers shop and buy online, retailers must embrace AI’s full capabilities and optimize their product content to include the details that help consumers find what they are looking for and ultimately make a purchase.

“Without an accurate and relevant product data intelligence layer, retailers put customer loyalty, brand reputation, and revenues at risk,” she advised.

Search Sluggishness Stalls Sales Surge

Table of Contents

Despite advancements in overall technology, a significant disconnect remains between retailers and consumers in the search and discovery process. That happens whether shoppers use a search engine, a social platform, or a retailer’s e-commerce site.

Gupta shared that today, 84% of consumers said it could take up to six searches to find what they seek, and 80% quit searching for what they want. Also, nine out of 10 reported needing to go to a physical store to examine an item further because the online product details lacked clear information to help them finalize their purchase decision.

“In this competitive retail environment, we shouldn’t make people work that hard to find what they want online. This is a problem. It’s frustrating for consumers. It means lost sales for retailers and brands,” she observed.

The research revealed that each shopping age segment uses different channels to discover new products. Across all generations, respondents said they prefer to start the discovery process using Amazon, but from there, consumers go their own ways.

For instance, Gen Z prefers using social media for discovery (56%). Millennials like to browse big box retail sites like Walmart and Target (46%). Baby Boomers (41%) and Gen X (41%) prefer using search engines.

Inconsistent AI Use Weakens Retail Strategy

Search engine ineptitude highlights the need for retailers and brands to optimize their product content. They need to improve and harmonize the search and discovery process across every possible channel.

Using language that connects their product content — from attributes and synonyms to titles and longer descriptions — will provide what shoppers actually want. When done correctly, the “midnight French terry athleisure top” from Brand A should come up in a Gen Zer’s search for a blue hoodie on TikTok, as well as a Gen Xer’s search for a navy sweatshirt on Google, Gupta explained.

A related issue is the staggered adoption of different AI options among outlets. Consumers are starting to use the next generation of AI to shop. A solid 40% of those surveyed said they had used one of these new search engines.

“It’s critical that retailers optimize their product content to be read by generative AI-powered search engines, e.g., Google AI Overviews, ChatGPT, or Perplexity. If product content is not more machine-friendly and optimized for AI and AI agents, they risk increasing declines in organic web traffic and sales, as well as reduced brand visibility and market share when their products aren’t recommended or show up in AI-powered results,” she offered.

Bridging Human and Machine Language

Gupta warned that the worst part of this optimizing personalization process is that merchant-driven product content is typically void of both natural consumer language and contextual understanding, meaning “consumer-speak.” It is also not optimized for AI, where agents and algorithms think “machine-speak” and are now making rational decisions and taking independent action.

“This has a significant negative impact on retailers and brands. If shoppers can’t find what they want, they are going elsewhere to find it,” she quipped.

The lack of consumer language has compounded adverse effects across advertising and e-commerce. Lower-quality product content drives less traffic and converts fewer visitors into sales.

“Product Content Optimization (PCO) bridges this gap. With AI, all the ways that consumers search for products can now be understood and answered with the optimal products, making it easier for people to find exactly what they want, no matter where they shop or search,” Gupta observed.

Retailers Struggle With Consumer Language Gaps

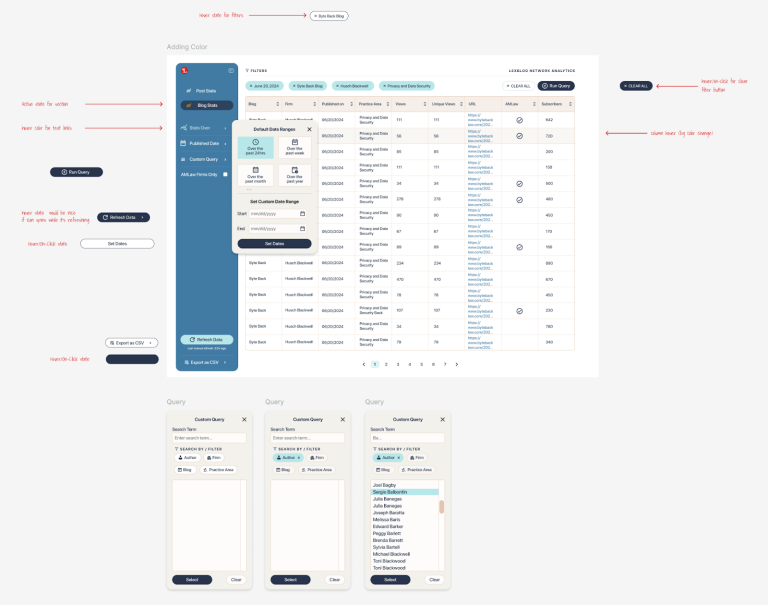

PCO is the automated, dynamic process of enriching product data with consumer, merchant, marketer, and machine-friendly product information. It integrates across a retailer’s advertising and e-commerce tech stack.

Brands and retailers can boost product discoverability across traditional channels like Google, TikTok, Meta’s Facebook and Instagram, e-commerce sites, marketplaces, and generative AI-powered search engines.

The Lily AI platform analyzes consumer searches and dynamically enriches product data with consumer-centric language customized and optimized for a given platform’s unique specs. The product content improvements span attributes, synonyms, trends, phrases, titles, and long-and-short descriptions in both consumer-facing and back-end contexts.

For example, if a red sweater is named and described as “cardinal luxe,” but a consumer is looking for “red cashmere,” the platform will have enough context to understand that “cardinal” is “red” and “luxe” is “cashmere.” As a result, the sweater called “Cardinal Luxe” will still appear in search results for “red cashmere sweater.”

Gupta reasoned that product content optimization helps ensure retailers have enough descriptors and context related to their products. So, when no exact search match exists, consumers can find the products they want.

“Retailers then benefit from increased impressions and higher conversion,” she noted.

Can AI Help Solve the Abandoned Cart Dilemma?

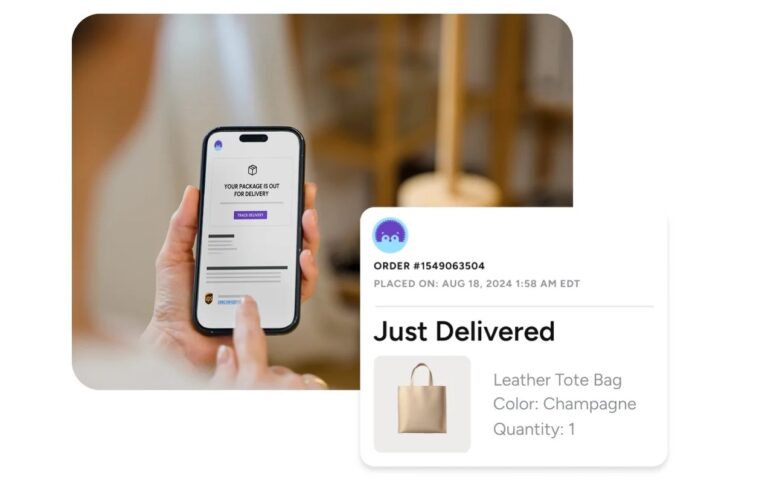

Nearly 90% of consumers have found a product online but purchased it in-store due to unanswered questions about product details. AI assistance can help provide clear, detailed product information to reduce cart abandonment and returns.

Lily AI’s research found that nearly 90% of shoppers had to visit a store in person because online product descriptions were unclear or overly complicated. The lack of clarity in these descriptions forces customers to take additional steps, undermining the convenience that online shopping is supposed to provide.

Clear, concise, and informative product descriptions are essential to honor customer time and expectations. Surveyed consumers shared their reasons for making in-store purchases instead.

- 52% wanted to see or try on the item

- 48% wanted to assess quality

- 42% had open questions about fit based on descriptions/reviews

- 29% complained the online product information lacked sufficient details

- 20% said the online product description used confusing or overly complicated terms

“While we don’t have data specific to how this reduces cart abandonment and returns, it’s safe to say that if customers have all of the information they need to make a purchasing decision, then that can be favorable to the retailer,” Gupta said.

She added that 85% of shoppers said they would buy a similar item from another brand or retailer if they failed to find a suitable product with their initial brand or retailer choice.

“This makes the details and clarity of product information absolutely critical,” said Gupta.

Retail’s Long-Term Plan for AI Integration

Gupta envisions AI transforming the e-commerce landscape through 2030. She urges retailers to prepare for the changes.

Today, the line between digital commerce and digital marketing is blurred. Retailers and brands need to understand the critical interconnectivity between these two functional areas.

“E-commerce and advertising have major product data dependencies on each other, necessary to maximize the effectiveness of both,” she said. “I also believe that agentic AI is here to stay and will only improve. It’s essential for retailers and brands to adopt AI early and experiment to remain competitive and relevant.” Gupta offered a final caution: This new world order requires the retail industry to change.

“We can’t operate as we have always done if we are to achieve the positive impacts of these AI advances. We need to be receptive to doing things very differently so that we can trust AI to do what it does best. Process re-engineering is as important as product content optimization here.”