Square just opened the Bitcoin floodgates. Here’s why it matters for your store.

In November 2025, something quietly remarkable happened: Square made Bitcoin payments available to eligible US merchants. Your neighborhood coffee shop can now accept Bitcoin as easily as they swipe your credit card. Payments are confirmed in seconds via the Lightning Network. There are no chargebacks. And through 2026, it costs merchants nothing.

This isn’t a crypto experiment. It’s Jack Dorsey’s Block company betting that Bitcoin belongs at the point of sale, powered by the Lightning Network and integrated directly into the hardware millions of businesses already use.

But to see this as merely another payment option misses the larger story. Square’s move sits at the intersection of several shifts reshaping commerce: the rise of digital wallets, the emergence of alternative payment rails, and a practical question about whether the 2-3% credit card processing fees on every transaction is actually inevitable.

The opportunity of Bitcoin payments is clear. As Miles Suter, Block’s Bitcoin Product Lead, put it: “When a coffee shop or retail store can accept Bitcoin Payments through Square, they enjoy instant access to funds and get to keep more of their revenue by avoiding credit card fees and chargebacks.”

Accepting Bitcoin at checkout works via the Lightning Network, a protocol built on Bitcoin, enables near-instant, low-cost transactions. Customers scan a QR code, the payment is confirmed in seconds, and merchants can choose to settle in BTC or instantly convert to US dollars. Square handles all of the backend complexity, including real-time exchange rate calculations, confirmation notifications, and settlement options.

Bitcoin payments are free through 2026, with a flat 1% transaction fee starting in 2027. Refunds process via digital gift cards for the USD equivalent.

Square is also rolling out Bitcoin Conversions, which lets merchants automatically convert a percentage of their daily card sales into Bitcoin. Bitcoin Conversions are optional and designed to help businesses that choose to manage part of their revenue in BTC. Square does not provide financial or investment advice.

Accepting Bitcoin transactions offers a number of practical benefits, including:

1. Near-instant or flexible settlements

Table of Contents

Credit card payments appear instant to consumers, but merchants know better. Actual settlement — when funds hit your bank account — takes days. And throughout that period, the transaction can be reversed via chargeback.

Lightning transactions confirm in seconds, not the days it takes for credit card funds to actually reach your account. If you’re settling to USD immediately, the Lightning payment is near-instant, but the last mile to USD in your bank still depends on traditional rails. But if you’re keeping some portion in BTC — for treasury, or for paying suppliers who accept it — that value is liquid and usable the moment the customer walks away.

2. Lower fees

Credit card processing fees typically range from 1.5% to 3.5% per transaction, with smaller businesses paying toward the higher end.

If you’re processing $10,000 monthly in card transactions, you’re paying $150 to $350 in processing fees alone. That’s before monthly minimums, chargeback fees, and equipment costs.

Square’s Bitcoin offering — Bitcoin payments are free through 2026 — represents real savings. Not transformative for every business, but for margin-conscious operations, an alternative option that may be attractive for some businesses.

3. Flexible setup

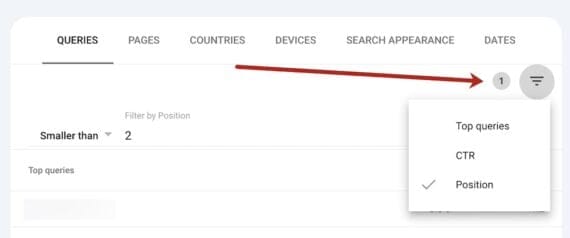

If you’re already using Square, enabling Bitcoin payments for your business is simple. The functionality can be turned on from either the Square Dashboard, or within the Point of Sale app. For now, Bitcoin payments are available for in-person transactions only.

4. Global currency

For merchants with international supply chains, Bitcoin offers something traditional rails don’t: the same currency on both ends. If your suppliers accept BTC, you can receive customer payments and pay invoices without currency conversion fees, international wire costs, or banking delays. No intermediary banks. No correspondent fees. Settlement in minutes instead of days. For cross-border commerce, this changes the math significantly.

5. Protection from chargebacks and payment disputes

One of the biggest advantages of Bitcoin payments is the elimination of chargebacks. Because Bitcoin transactions are final and can’t be reversed or disputed, merchants avoid the operational and financial drain of fraud-driven chargebacks that are common with credit cards. For Bitcoin transactions, this means no chargeback fees, no revenue clawbacks weeks after a sale, and no time spent responding to disputes.

Refunds for Bitcoin purchases can still be offered, but they’re issued as Square gift cards in the equivalent USD amount — giving merchants protection and as a consideration for your customer experience.

Here’s a trend that matters regardless of your crypto stance: digital wallets are becoming how people pay.

By mid-2025, 65% of US adults used a digital wallet, up from 57% in 2024. Digital wallet transaction values hit $10 trillion globally in 2024. But, the generational divide is stark: 69% of Gen Z adults have adopted mobile wallets versus 27% of Baby Boomers.

The number that should get your attention: 51% of consumers won’t shop at stores that don’t accept digital wallets. For Gen Z, that rises to 78%.

Apple Pay, Google Pay, PayPal, Cash App — these aren’t optional anymore. They’re table stakes. And increasingly, these wallets are adding crypto capabilities. Square’s move is part of a broader convergence where the wallet becomes the universal interface for all payment types.

Digital wallets aren’t just changing how people pay — they’re starting to change who initiates payments.

Across the payments industry, major platforms are experimenting with AI-assisted purchasing. Google has introduced early standards for agent-initiated payments. Mastercard, Visa, and PayPal have announced tools that let AI systems assist with checkout and transaction execution.

The near-term use cases are simple — helping users find and buy products faster — but the underlying shift is meaningful.

Traditional payment rails were designed for human users: manual approvals, delayed settlement, and chargebacks. Newer digital and crypto-based rails prioritize speed, programmability, and finality. Those characteristics make them easier to integrate into automated or software-driven payment flows.

Square has not announced plans specific to AI-agent commerce. But the broader direction of the industry helps explain why companies are investing in faster, more flexible payment infrastructure. As Gartner projects increased adoption of agentic AI across enterprise software in the coming years, payment systems that support real-time, software-initiated transactions are becoming more relevant.

Bitcoin at the point of sale isn’t about replacing cards tomorrow. It’s about ensuring that modern commerce infrastructure can support how payments may be initiated and processed in the future.

Square’s Bitcoin launch signals where commerce infrastructure is heading. Digital wallets are becoming the default. Alternative payment rails are gaining traction. The 2-3% credit card fee is no longer the only option.

For new Woo merchants, the practical questions are:

- Are you wallet-ready? If you’re not accepting Apple Pay and Google Pay, it’s likely that you’re losing sales — especially from younger customers. This gap will grow with time as more consumers prefer digital wallets over traditional payment methods.

- Do the fees matter to you? If you’re running tight margins or a high transaction volume, alternative rails like Bitcoin (with 1% or lower fees) deserve consideration against your bottom line.

- Do you have international suppliers? If your supply chain can accept BTC, you can eliminate currency conversion and wire fees entirely.

- Are you watching this space? You don’t need to accept Bitcoin tomorrow. But understanding the shift and any accelerating trends helps you make better decisions as your business grows.

Your store probably just needs to accept credit cards and digital wallet options today. But the infrastructure currently being built will define commerce for the next decade.

Square sees it. Now you do, too.

Get paid with Square.

Square Bitcoin payments are available to eligible US Square Sellers, excluding New York, are subject to regulatory requirementsEnable Bitcoin Payments and Bitcoin Conversions in your Square Dashboard or Point of Sale apps. Free through 2026, then 1% per transaction. Learn more at Square.

About

Dave Lockie

Dave is a visionary at the forefront of the Web3 revolution and currently leading the charge at Automattic. A native of the UK, Dave now soaks up the sun and tranquillity in Portugal. Dave shares his Web3 expertise through his advisory role at Adnode and past collaborations with WordProof, Grant for the Web, and his founding venture, Pragmatic. He also co-chairs the BIMA Web3 council.