Younger consumers aren’t just changing how they shop — they’re rewriting the rules of customer service. When a charge looks wrong, they don’t call, email, or wait on hold. They open a banking app, dispute the transaction, and move on. For merchants, the danger goes far beyond lost revenue — it’s a direct threat to customer loyalty.

Consumers aged 18 to 44 — particularly Gen Z and millennials — are driving a generational shift in dispute behavior. They focus on mobile-first habits, digital payment tools, and expectations for instant resolution, according to the Chargebacks911 2025 Cardholder Dispute Index. The report cites responses from over 1,200 cardholders in the U.S. and U.K.

Monica Eaton, CEO of Chargebacks911, observed that staying competitive now requires merchants to invest in digital dispute prevention efforts before banks become the first point of contact for disgruntled customers. This approach includes resolving transparent billing issues, providing accurate billing descriptors, streamlining refund flows, and offering always-available customer support.

“Younger shoppers are digital natives who want what they want, when they want it. When it comes to disputing a transaction with a merchant, they aren’t waiting on hold, searching for support emails, or even looking to speak to an actual person,” Eaton said.

Instead of contacting merchants, they open their bank app, file a dispute, get an instant refund, and move on. It’s convenient and works nearly every time.

“If merchants aren’t meeting them with digital-first solutions, they’re already behind,” she told the E-Commerce Times.

CX Must Adapt to Bank-First Behavior

Table of Contents

These behaviors reveal more than young consumers’ preference for convenience. Their bank-first mentality points to an evolution in consumer expectations.

The Chargebacks911 study showed that 83% of shoppers in this age bracket demand fast, seamless, app-driven service. More than half of younger consumers skip contacting the seller altogether and instead initiate disputes directly through mobile banking apps.

Younger shoppers reward brands that deliver on their promises with loyalty, while punishing those that fail with disputes and defection. For comparison, just one-third of consumers over 60 disputed a transaction without contacting the merchant in the past year, according to the dispute resolution and chargeback prevention company.

“This isn’t just about better fraud protection. It is about adapting to the modern customer experience,” Eaton added. “Brands must shift from reactive dispute management to proactive, frictionless support if they want to survive this generational shift.”

Sets Pace for Repeat Chargebacks

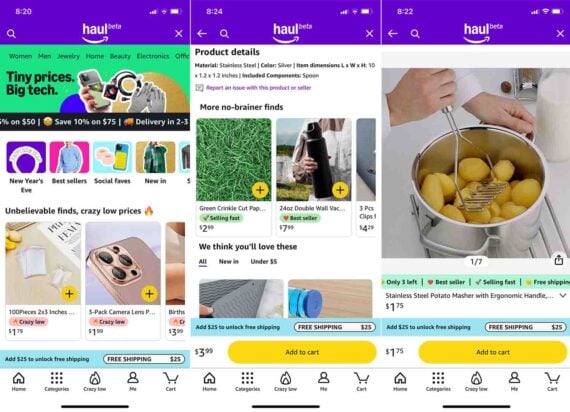

Eaton compared the disconnect between younger consumers and out-of-date merchant responses. Younger shoppers grew up with instant everything. Platforms like Amazon set expectations for instant refunds — a speed many merchants rarely match.

Banks have replicated that ease inside their mobile apps: filing a dispute feels like ordering food delivery — quick, familiar, always available. Merchants typically require customers to search for a helpline number, wait on hold, and maybe fill out a form.

“Most people will take the fast lane every time. The trust isn’t just in banks being better, it’s that banks are consistent, predictable, and built right into the device that’s already in their hand,” Eaton explained.

The reality is that once a customer wins a dispute, it becomes part of their standard operating procedure. The next time something feels off, they do not even think about calling the merchant. They go straight to what worked last time — the bank, she added. “It’s a loop that keeps repeating until the merchant steps in and changes the experience.”

Chargebacks Cost More Than Revenue

Merchants lose more than just transactions. Every successful dispute chips away at customer retention, adds operational cost, and paints the business as high-risk in the eyes of banks and networks.

Nearly half of younger consumers use buy now, pay later (BNPL) services, which can put them at odds with retailers, noted the Chargebacks911 report. The rise of these alternative payment methods influences dispute behavior.

Eaton explained that, especially with younger shoppers, alternative payment methods like BNPL involve more moving parts, including installments, multiple parties, and delayed payments — complexity that often leads to misunderstandings. A shopper might forget that a payment is due, not recognize the line item, or think they were billed twice.

“If the merchant’s resolution flow is clunky, the shopper will tap ‘dispute’ inside the BNPL app or through their bank. That’s where you see ‘friendly fraud,’ not because people are malicious, but because the fastest option feels like the best one,” she offered.

Eaton suggested that merchants streamline this process by syncing policies and refunds with BNPL providers, sending billing reminders before charges are due, and making it just as easy to cancel or return as it is to make a purchase.

Confusing Bills Trigger Disputes

The Cardholder Dispute Index cited that 40% of consumers don’t recognize charges due to confusing billing descriptors. Billing descriptors are one of the most overlooked aspects of the customer journey that can lead to dispute complaints, Eaton noted.

“Shoppers see a line of text on their statement that looks nothing like the brand they bought from, and panic sets in. Some of the worst offenders are random abbreviations, parent-company names, or strings of numbers that mean nothing to the consumer,” she added.

She suggested the single best fix is to make billing correspondence recognizable. Put the brand name right there, add a short URL, and even include a keyword like “order” or “help” to prevent thousands of unnecessary disputes every year.

Eaton sees the ongoing technological growth of digital payments exposing consumers to more stumbling blocks, which can lead to knee-jerk reactions to bank-first complaints. The next wave of payments will be even more invisible: tokenized, embedded, happening behind the scenes.

“That will make disputes feel even more natural for consumers, because everything else is so automated,” she warned.

Redesign CX to Prevent Complaints

Eaton recommended that merchants invest in digital dispute prevention before the bank becomes the first point of contact, including:

- Explicit billing descriptors

- Instant receipts with order details

- Proactive shipping updates

Then layer in automated refund options for low-risk claims, transparent subscription reminders, and real-time support across email, chat, and SMS.

Additionally, merchants should connect directly with the issuer and network tools that enable them to deflect invalid disputes before they occur. Prevention isn’t only one thing — it’s an ecosystem.

“Merchants that build this digital-first safety net will see disputes shrink and loyalty grow,” she said.

Partner With Banks To Prevent Chargebacks

To help stem that rising tide of chargeback complaints, Eaton suggested that merchants prepare now for real-time collaboration with banks and payment networks. Also include proof-of-delivery notices that go beyond tracking numbers and clearly state subscription rules.

“The consumer of the future will expect instant refunds and one-tap resolutions. So merchants need to treat dispute prevention as part of the customer experience to ensure they win loyalty,” she urged.